Introduction: 'Habits to Save' Newsletter

why I created this newsletter + my habits:fun ratio journey

I love saving money. And I’d wager a pretty penny that you do too.

The financial ups and downs in my life have convinced me that consistent money-saving habits (not hacks, habits) are key to feeling financially secure.

I created this newsletter for two practical reasons:

I want to share my habits, in case they are useful for you. I will write posts about how I save money on the regular, the habits I have formed in my daily life to support this, and invite you to consider a new perspective on saving money.

I really want to learn from you. You have formed many habits that I have not yet considered, or you have already improved upon my own. I humbly invite you to share them through comments, guest posts, direct notes, or any other way you feel comfortable. I am all ears and eyes!

My Journey:

Life is all about the right balance. A balance/ratio that is optimal for you and your current time and situation.

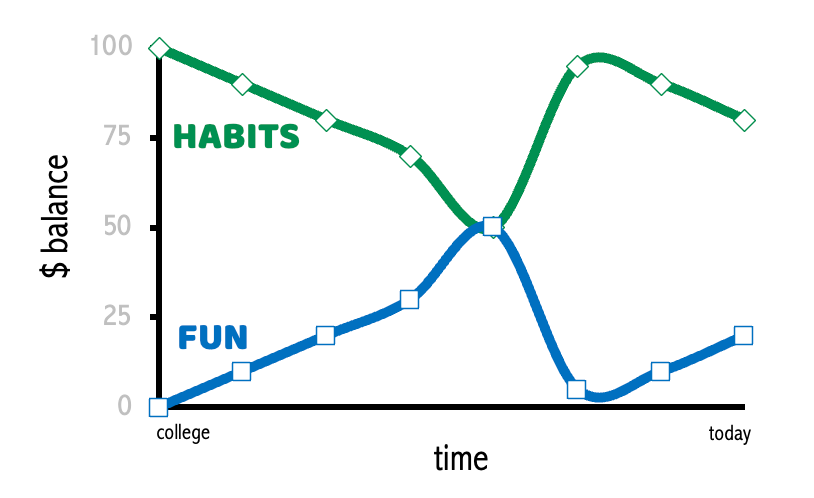

I call this a “habits:fun” ratio.

In my current time, I am at a ratio of 80:20. I let my saving habits guide me 80% of the time, while allowing the fun side guide the other 20%.

But I went through all kinds of ratios in my journey to get here.

100:0 ratio when I left for college at 17.

With a single mom, I was responsible for all my college expenses. This was survival mode. I had ~$1500 to my name. I got a part time job, applied for as much financial aid as I could, took some student loans, ate cheaply, all while trying my best academically. 99% of my money went into expenses, with a teeny tiny bit leftover for that occasional treat (which I usually spent on a giant burrito at a local place!). I credit this phase for helping me form my saving habits, I would not change this foundational life lesson in any way.

90:10 ratio when I graduated from college and got my first job.

With an underwhelming salary, I still felt good. I had more money than ever before. I could cover expenses (rent, food, paying off student loans) and still have money for fun things like a road trip with friends, eating at better restaurants, as well as investing some of those savings (even if rather small). A significant compromise I made was continuing to share a room rather than have my own room or apartment.

80:20 ratio when I was in graduate school.

I chose a program that gave me a small stipend to cover living expenses and a bit for fun. Luckily my student loans were paid off (phew!) and I had some savings. A key habit I formed was to always couple my personal travel with school travel (e.g. conferences, symposia, field trips, etc.) where flight costs were covered by my department.

70:30 ratio when I got my first big job + had joint finances with my partner.

We had more funds available for the fun stuff (travel and food) after managing our expenses. This balance felt good as we were being responsible but also freely enjoying life. An important decision was not to buy a home to remain mortgage free and flexible.

50:50 ratio when my partner and I had a few good financial years.

As our careers progressed we earned more income, pushing us into this dreamy ratio of responsibility vs fun. We worked hard and easily took care of our expenses. We moved to a higher cost of living area where there was more opportunity. But we also had a substantial amount leftover. We invested a good chunk of it and used the rest for more travel. These were wonderful years, unbelieving we had this kind of luck!

95:5 ratio when we fell on hard times for a couple of years.

This period transversed the COVID pandemic. Sadly, I lost my job first. My partner’s income allowed us to quickly adopt the 70:30 ratio. But then my partner lost his job too and we had zero income. We hunkered down and reviewed our expenses. We made cuts where we could; the biggest one was moving to a lower cost of living area. We kept ~5% for fun for the sake of our sanity but we were in hulk-like economical mode so we would not dip into our savings or investments too much (which are important for long-term financial wellbeing). This was a tough time but we made it work.

90:10 ratio when we began our recovery.

My partner found a job that payed well. We were thankful for this positive news and slowly, carefully adjusted our habits accordingly.

80:20 ratio is where we are at today.

We both work, have reasonable income (but not as good as when it was 50/50 ratio), and are very thankful. We feel comfortable in this 80/20 space where we pay our bills and also get to have fun.

As in my life, and probably in your life, ups and downs will come and ago. While I hope my future graph is less volatile, I will not know until I get there. But I know I am forming the right habits to tackle the unknown.

The critical skill is our ability to quickly adjust to any unexpected changes. This adjustment significantly leverages the habits we form over time, habits that guide quick decision making in moments of downturn, while still making room for enjoyment in life.